Business Loan Calculator

Use our business loan calculator below to find out how much you can borrow to take your business to the next level.

Want to understand the cost of your loan?

Use our business loan calculator below to find out how much you can borrow to take your business to the next level.

Calculations are indicative only and intended as a guide only. The figures calculated are not a statement of the actual repayments that will be charged on any actual loan and do not constitute a loan offer.

Monthly payments

-

Monthly interest

-

Total interest

-

Length of loan

-

Total cost of loan

-

Business Loan Calculator

Looking to estimate monthly repayments or overall costs for a business loan? Our business loan calculator is designed to help UK businesses—from start-ups to established companies—gain a clearer picture of potential borrowing costs. By entering a few simple details, you can compare options and decide which route is best for your goals, whether you’re seeking a small business loan, a commercial property mortgage, or asset finance to invest in new equipment. Please note that the results are indicative only.

How our business finance calculator works

- Enter the loan amount: estimate how much you plan to borrow.

- Select the interest rate: our business loan rates calculator allows you to tweak rate assumptions to see how it affects monthly and total repayments.

- Choose your repayment term: decide whether you need short-term funding or a longer-term solution.

- Review your repayments: the business loan repayment calculator will show estimated monthly costs, overall interest, and total repayment amounts. Note: All results are indicative and may vary depending on the actual terms offered by your chosen lender.

Small business loan calculator & start-up options

Many entrepreneurs use a business startup loans calculator (or start up loan calculator) to understand how repayments will fit into their cash flow. This is crucial for new businesses managing limited initial revenue. Whether you’re launching a tech startup or opening a local retail shop, a clear picture of potential costs can help you plan effectively.

Commercial loan repayment calculator

If you’re seeking larger-scale funding, a commercial loan calculator can give you insights into monthly commitments for major projects—like purchasing a new warehouse or expanding your operations. The commercial loan repayment calculator estimates how different interest rates and repayment terms affect your total outlay, helping you make an informed decision about the right financing structure.

Business mortgage calculator & commercial property mortgage calculator

For businesses looking to purchase or refinance commercial real estate, our business mortgage calculator and commercial property mortgage calculator can help you work out estimated monthly repayments. By considering principal, interest rates, and any additional fees, you can see how property ownership might compare to renting in the long run.

Limited company mortgages & buy-to-let scenarios

If you’re operating under a limited company structure, tools like a limited company mortgage calculator or limited company buy to let mortgage calculator can be invaluable. These calculators factor in corporate structures, tax considerations, and other details relevant to company-owned properties—whether it’s office space, a rental portfolio, or mixed-use developments.

Asset finance calculator

Need to purchase equipment, vehicles, or machinery without tying up all your working capital? An asset finance calculator lets you estimate monthly repayments based on the cost of the asset and the lease or hire purchase terms. This way, you can plan investments to grow your business while preserving cash flow for daily operations.

Why use a business loan calculator?

- Quick estimates: instantly gauge how much your monthly repayments could be.

- Cash flow planning: budget effectively, especially if you have seasonal revenue.

- Compare rates: see how even a small change in interest rate affects your total repayment.

- Informed decisions: whether it’s a startup loan calculator or asset finance calculator, you can gauge overall affordability before proceeding.

We're here to help

Find the right Funding Options without affecting your credit score by filling out our quick and easy form.

See your Funding OptionsHow does it work?

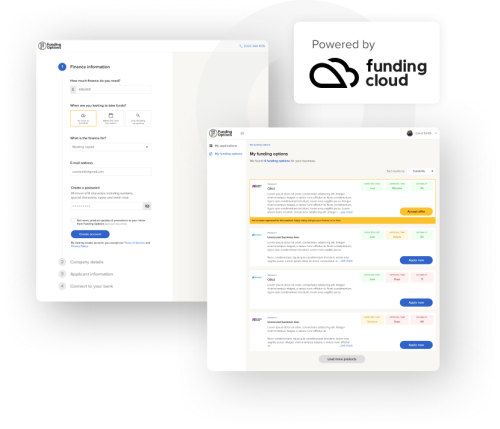

We break down funding barriers with a simple application process that empowers you. Our technology, Funding Cloud, accurately validates your business profile, matching you to the industry’s largest lender network. Funding results are uniquely tailored to each and every business.

Tell us how much you need

Tell us how much you need to borrow, what it's for and provide some basic information about your business.

Get an instant comparison

Our smart technology will compare up to 120+ lenders and match you with the right finance options for your needs.

Apply and get your funding

We'll help you through the process from application to receiving your funds.